Contents

Fundamental analysis helps determine whether the stock is undervalued or overvalued, and technical analysis determines the right time to buy or sell a stock. In fundamental analysis, the trigger for the investor is to wait and invest when the stock/security prices are below their intrinsic value. In technical analysis, an investor buys a stock if he believes that the stock is in the uptrend, so he can make quick profits by selling at higher prices. Similarly, as per the technical analysis, if the stock is in a downtrend, then the trader will sell the stock and earn by buying it back at lower prices. So the key difference is that in fundamental analysis, the buying happens with a higher target.

Intrinsic value is the perceived or calculated value of an asset, investment, or company and is used in fundamental analysis and the options markets. Investors and analysts will frequently use a combination of fundamental, technical, and quantitative analysis when evaluating a company’s potential for growth and profitability. It helps investors determine the right time to enter and exit the market.

Buy and sell signals are generated when a shorter duration moving average crosses a longer duration one. Fundamental analysis evaluates stocks by attempting to measure their intrinsic value. Fundamental analysts study everything from the overall economy and industry conditions to the financial strength and management of individual companies. Earnings, expenses, assets, and liabilities all come under scrutiny by fundamental analysts.

Any investment or trading is risky, and past returns are not a guarantee of future returns. Whether you’re buying stocks and bonds, real estate, or cryptocurrencies, you’re hoping to buy at a low price so someday you can sell at a higher price, earning a profit in the bargain. On one hand, fundamental analysis is suitable for individuals who have a long term investment perspective.

Fundamental vs Technical Analysis – All You Need to Know

Fundamental analysis is the most suitable way to shortlist stocks for a long-term investment. You can use Tickertape’s stock screener with filters like P/E ratio, profitability, and multiple sub-filters for quantitative analysis. And filters like ownership, market cap, and stock universe for qualitative analysis to pick your best stocks. For instance, a bank’s revenue might outpace competitors, but its stock price could be threatened by falling interest rates.

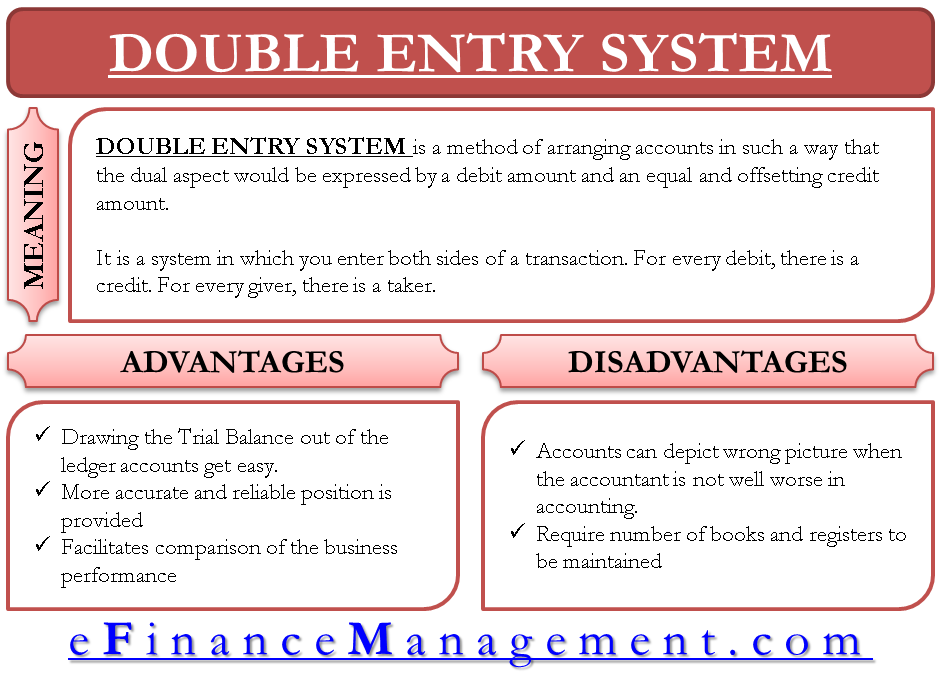

Fundamental Analysis is based on financial statements, whereas technical analysis is based on charts with price movements. The price at which the buyer and seller of the share, decides to settle the deal, is one such value which combines, weighs and expresses all the factors, and is the only value which matters. In other words, technical analysis gives you a clear and comprehensive view of the reason for changes in prices of a security. It is based on the premise that the price of share move in trends, i.e. upward or downward, relying upon the attitude, psychology and emotion of the traders. The fundamental analysis determines the internal value of the security. In contrast, technical analysis determines the future prices of the stock.

Other key factors in technical analysis include support and resistance, moving averages, indicators and oscillators. You can use Tickertape’s stock screener with its wide range of filters, including EMAs, 1-year max loss, and super trend to have a go at predicting the future of your preferred stocks. Portfolio risk can be managed by calculating the premium to fair value at which stocks are trading.

When to Use Fundamental, Technical, and Quantitative Analysis

Culture & CareersAttracting and retaining skilled, passionate people in the investment management field is the key to our success. Founded in 1978, Renaissance Investment Management is a registered investment advisor based in the greater Cincinnati, Ohio, area. Tracing its history back to 1946, Montrusco Bolton Investments Inc. is a private investment management firm.

- It predicts how a stock will perform in the future, i.e., whether its price is expected to increase or decrease over a shorter period.

- It entails recognizing patterns in charts containing historical data on the price movement of a stock.

- Fundamental analysis is the most suitable way to shortlist stocks for a long-term investment.

- It tells you how much it owns in terms of wealth, how much it has to repay and how much cash is still owed by the customers.

Therefore, it uses the historical price movements, trade volumes and returns to forecast the stock prices. Moreover, technical analysts are of the assumption that all the fundamental aspects of the stock are already factored in, and they remain unchanged. One of the main benefits of fundamental analysis in crypto is that it provides a comprehensive understanding of a cryptocurrency’s future potential.

Common Option Trading Strategies Every Trader Should Know

There are countless chart patterns out there, but don’t think you need to learn them all. Liabilities are a company’s debts that the company will eventually have to repay. The P/E ratio is a simple way of determining whether a stock is cheap or expensive compared to other points in history and compared to other stocks. For example, a stock currently trading at $20 with an EPS of $1 is trading at a P/E ratio of 20. If you are an engineer, you should start with accounting first and then move to financial modeling courses.

On the other hand, Technical analysis tries to predict the next ‘up move’ in a stock’s price and is indifferent to the company’s business. Selling a good stock only difference between technical and fundamental analysis after one ‘up move’ in its price is not a long-term winning decision. Rather, long-term investors use technical indicators to perfect their entry into equity.

Fundamental vs. Technical Analysis Comparative Table

The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice. Should you need such advice, consult a professional financial or tax advisor. How much money the company makes, spends or owes are all contributing factors which must be taken into account. Similar results were presented by Mitra , and Ratner and Leal when they compared the returns obtained from the generation of buy or sell signals with the returns of a static strategy such as buy and hold.

Fundamental analysis and technical analysis are the major schools of thought when it comes to approaching the markets. One needs to understand that ultimately, in the long run, the security or stock value has to relate to its performance and fundamental attributes. Since it assumes that current prices reflect all available information, it helps provide up-to-date information without much hard work, like in the https://1investing.in/ case of fundamental analysis. On the other hand, the technical analysis makes many assumptions, including the key one that says prices will follow a similar trend. In fundamental analysis, both past and present data are considered, whereas, in technical analysis, only past data is considered. But since the data of this analysis is based on just the present data, the market trends tend to be unpredictable.

Technical analysis

On the other hand, technical analysis uses past charts, patterns and trends to forecast the price movements of the entity in the coming time. Fundamental analysis in crypto involves the study of a cryptocurrency’s underlying technology, adoption rate, and other factors that could impact its future performance. Fundamental analysts believe that these factors are the key drivers of a cryptocurrency’s price and that understanding them can help them make informed investment decisions. This approach is often used by investors looking to make long-term investments in the cryptocurrency market.

Fundamental analysis is focused on estimating the current value of the stock , whereas technical analysis is focused on estimating the entry and exit time in the market. Once you are confident that the company fulfills most of the criteria mentioned above, then study the Annual reports of the company. It is the single most important document that every investor should read.