India is one of the world’s largest energy consumers and as a country committed to reducing its carbon footprint, the demand for green hydrogen stocks India is expected to grow in the coming years. In 2021, L&T and ReNew Power, India’s leading renewable energy company, signed a partnership agreement to tap the emerging green hydrogen business in India. Furthermore, the company has chosen to build an environmentally friendly hydrogen plant in Gujarat’s Hazira district.

The company also recently raised $7 million via a share placement and announced an additional $7 million share purchase plan. Funds will be used to support and expand Hazer’s business development activities, enhance ongoing research and development programs and for general working capital. Perth-basedGlobal Energy Ventureshas unveiled plans to develop a 2.8GW green hydrogen export project on Tiwi Islands, NT to produce and export up to 100,000tpa green hydrogen into the Asia Pacific region.

It has consistently paid dividends for more than ten https://1investing.in/ years. The company’s business is spread over many countries like China, United States of America, Belgium, United Kingdom, Denmark etc. On the weekly chart, the stock is well supported near the 200-day EMA, presenting a good investment opportunity in Linde stock. Yellow Hydrogen – To obtain this, electrolysis is performed with solar energy as the source. Today, these are the 8 top stocks you will find on TipRanks’ Green Hydrogen Stocks Comparison page. Click on any stock to thoroughly research it and determine whether you want to add it to your portfolio.

Adani Green Energy Ltd

Eden did not disclose any specific deals but noted the interest and level of enquiries has stepped up significantly over the last 12 months. It said some have already resulted in sales of Eden products, or ongoing trials and/or discussions which have the potential to develop into future market opportunities. Eden also revealed it has been approached by several companies in regard to its patented methane pyrolysis technology, which produces carbon nanotube, carbon nanofibre, and hydrogen from methane without producing carbon dioxide.

- By the end of 2023, GAIL intends to construct the most significant green hydrogen plant in India in the Guna district of Madhya Pradesh.

- You see, 95% of the hydrogen widely used and produced today through a process called “steam methane reforming”. This process uses a catalyst to react with methane and steam to produce hydrogen.

- As the transition to renewable energy unfolds, green energy penny stocks have the potential to see massive gains.

- Bloom Energy has provided these fuel cells for clients such as Coca-Cola, Walmart, and Staples, to name a few.

NTPC is implementing many green hydrogen pilot projects as part of its goal to reach 60 GW of renewable energy capacity by 2032. Ballard will supply a fuel cell module to Fusion Fuel who will use the fuel cell in its green hydrogen production plant, providing electricity during peak times. Plug Power has partnered with Brookfield Renewable to build a green hydrogen plant in Pennsylvania. Wanting to become the leader in green hydrogen production, it also announced plans to build another green hydrogen production facility in California. Air Products plans to have a world-scale green hydrogen ammonia facility operational by 2025.

What Are Green Energy Stocks?

This supports helps support the site as we donate 10% of all signing bonusess to sustainability organizations that align with our values. Best stock discovery tool with +130 filters, built for fundamental analysis. Search Stocks Industry-wise, Export Data For Offline Analysis, Customizable Filters. Indian Oil Ltd. is a dividend stock with a high dividend yield of 10.7%.

The Middle East Is Looking To Dominate The Green Hydrogen Market – Markets Insider

The Middle East Is Looking To Dominate The Green Hydrogen Market.

Posted: Thu, 16 Mar 2023 20:10:37 GMT [source]

Eden believes this could open significant market opportunities for the Hythane technologies that will also assist in the reduction of greenhouse gas emissions in these countries. Known as the Vienna Basin H2 project, ADX plans to repurpose its Gaiselberg and Zistersdorf oilfields and commence a pilot operation utilising a 1MW electrolyser to produce, store and on-sell green hydrogen in the local gas network. In late 2020, Energy and Emissions Reduction minister Angus Taylor released the Australian Government’s first Low Emissions Technology Statement as part of the nation’s Technology Investment Roadmap. The statement included a priority to adopt cost-effective technologies to achieve renewable hydrogen production for less than $2/kg. Also fuelling demand for green hydrogen is the growing focus on environmental, social and governance principles by companies and investors alike. We all are aware of the fact that global warming and climate change are some of the major concerns of the world.

Green hydrogen versus blue hydrogen

This strong core business provides a robust forward yield of more than 3.5%. Thus, an investment in Shell provides a unique, but long-term way, to play hydrogen stocks right now. State-owned NTPC is the leading energy provider in India with 69 GW of installed capacity and a diverse fuel mix.

As India aims to achieve energy independence by 2047, green hydrogen is regarded as a key facilitator of India’s shift to cleaner fuels. Therefore, it is receiving a great push both from the government and the private sector. In early January, NTPC commissioned India’s first green hydrogen blending project in collaboration with Gujarat Gas Ltd .

Province also recently secured its first licence for the project, a 98.6sq km site north of Carnarvon planned to be the production site and home to some upstream generation assets. This study commenced in early October and is due for completion in the June quarter of 2022. Pilot called the exploration well a “key step” in assessing the feasibility of developing its proposed South West carbon management and blue hydrogen project. Subject to regulatory approvals and land access, drilling is scheduled to commence by December 2022. We have already identified a handful of potential locations, and we are focussing on the selection of the first site,” he added. In October, Lion said it is close to completing the second stage of work outlined in its hydrogen strategy and is focusing its initial efforts on the production and delivery of green hydrogen for the domestic heavy mobility market.

The company plans to do that from its upcoming 4,750 MW renewable energy park at the Rann of Kutch. The US has invested $150 m in hydrogen fuel infrastructure and development every year since 2017. Governmental bodies in Europe and Asia are also investing more than $2 bn annually in hydrogen fuel production. At present, the country’s entire production of hydrogen comes from fossil fuels.

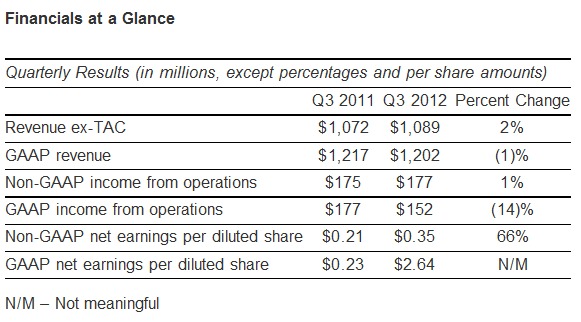

Financially, Linde provides investors seeking the best hydrogen stocks to buy plenty of positive attributes. On the balance sheet, it features an Altman Z-Score of 3.78, reflecting low bankruptcy risk over the next two years. Operationally, the company posts three-year revenue growth of 9.9%, beating out 63.5% of the competition. On the bottom line, its net margin of 11.4% outpaces over 70% of its peers. In many ways, the case for the best hydrogen stocks to buy practically sells itself.

More than 40% of India’s primary energy needs, which cost over $90 bn annually, are met through imports. Furthermore, industries such as transportation and manufacturing depend heavily on the fossil fuels that are imported. Therefore, there is a need for technology that can increase the use of renewable sources in the energy mix and reduce reliance on fossil fuels gradually. In January 2023, the power generation company commissioned India’s first green hydrogen blending project as a joint effort with Gujarat Gas Limited . If you are looking for ways to invest or trade in green hydrogen stocks, then Admirals is a possible option for you.

It analyses more than 20 million data points and rates every stock between one star to five stars based on 50+ rating parameters. You also get detailed observations in the form of pros and cons which gives you an insight on which stocks to buy and which to stay away from. The boom of ESG investing could also be seen in the returns offered by ESG stocks. It is well known for manufacturing high quality and advanced technology. The company has won a national award for manufacturing the world’s first fully tempered 2mm thick solar glass. While it can be stored as ammonia, a more stable form, reconversion is expensive.

As with Shell above, Air Products enjoys quite a few positive attributes. For starters, the company’s Altman Z-Score hits 4.93, indicating very low bankruptcy risk in the next two years. Operationally, Air Products’ three-year revenue growth rate stands at 12.3%, beating out nearly 71% of its peers. With interest rising sharply for alternative energy, these are the best hydrogen stocks to buy. Indian Oil Corp is one of the PSU that plans to tap into the green hydrogen opportunity.

3 stocks to green-up your Stocks and Shares ISA – Hargreaves Lansdown

3 stocks to green-up your Stocks and Shares ISA.

Posted: Wed, 22 Mar 2023 07:00:00 GMT [source]

As an emission-free fuel and a green energy source to decarbonize other industries, green hydrogen will play a significant role. Over 40% of India’s primary energy needs, or over USD 90 billion annually, are imported. In addition, essential industries like transportation and manufacturing are heavily reliant on imported fossil fuels.

Nevertheless, priced at 29 cents a pop, AFC will likely attract speculative interest. Presently, Wall Street analysts peg APD as a consensus moderate buy. Moreover, their average price target stands at $327.73, implying an upside potential of nearly 15%. Adding to the encouraging tone, hedge funds also support APD, rating it very positively. The Views and Investment suggestions expressed by the author or employees of Greynium Informations Technologies, should not be construed as investment advice to buy or sell stocks mentioned above.